5 Tips To Stop Involuntary Churn On Shopify For A Seamless Shopping Experience

We’ve all heard of customer churn, but what about involuntary churn? Involuntary churn can be a silent killer in the eCommerce world. It accounts for a staggering 20-40% of the overall churn rate across the online market. This insidious force, if left unchecked, will wreak havoc on your Shopify business.

So, what is involuntary churn and which things can you do to combat it?

Learn the best tips to build a involuntary-churn-free Shopify store with GemPages!

Understanding Involuntary Churn

Let’s start with the definition. Involuntary churn occurs when a customer stops doing business with a company, a brand, or an online store due to factors outside of their control. Popular causes include payment failures, account closures, and other external factors - more on those later.

Involuntary churn is particularly frustrating for businesses. It represents revenue losses that could not have been retained with better processes or interventions. Customers leave or abandon the store due to gaps in its operational or transactional systems.

Learn more: Customer churn in eCommerce: The silent revenue killer and how to fight back

Involuntary Churn in Shopify

Even a big eCommerce platform like Shopify can’t escape involuntary churns. Depending on the industry, churn rates on Shopify can get as high as 82% (in consumer electronics). This means only 18% of buyers would come back for a second purchase. Eliminating involuntary churn may present an uplift of over 30% to the store’s loyal customer base.

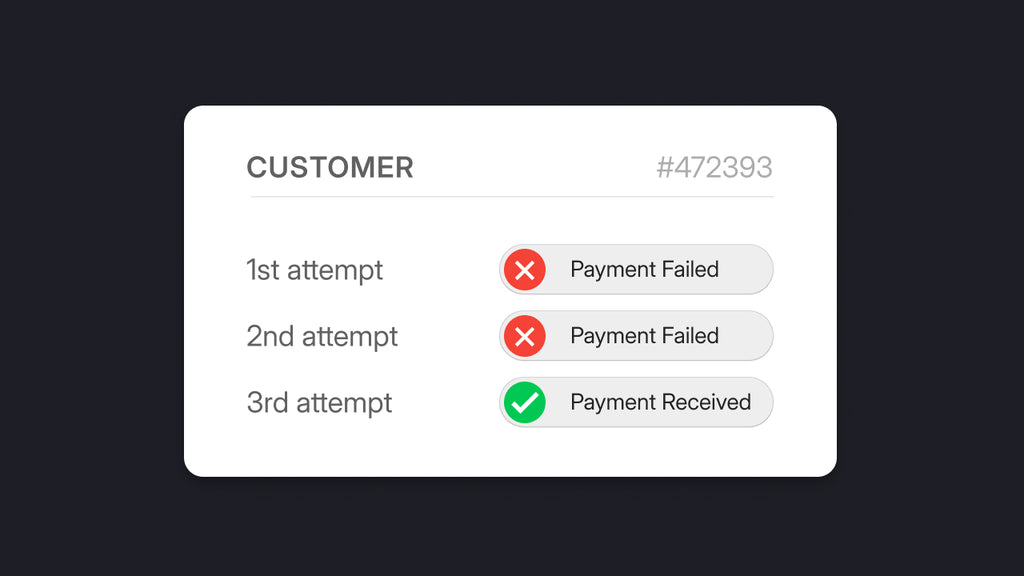

Normally, Shopify involuntary churn happens when a customer's subscription is unintentionally canceled, typically because of issues like expired credit cards, insufficient funds, or failed payment attempts. The customer doesn’t choose to leave, but external disruptions make them drop the purchase.

Failed payments can easily lead to involuntary churn!

Common Causes of Involuntary Churn

Involuntary churn can be the result of multiple factors. Here are the most prevalent reasons:

- Payment Failures: This is one of the primary causes of involuntary churn on Shopify, as well as other eCommerce platforms. When a customer’s payment method is declined or their subscription expires, it can lead to the customer dropping the purchase. Expired credit cards, insufficient funds, and bank issues are the usual culprits.

- Website Downtime: An offline or unstable store causes involuntary churn by preventing customers from renewing purchases or updating subscriptions. Poorly designed pages with slow load times frustrate users and increase abandonment rates. Additionally, lack of mobile optimization makes navigation difficult, hindering transaction completion.

- Capped Credit Limit: 62.6% of all retail purchases (in-store and online) are paid with a credit card in the US. Capped credit limits (when the customer's credit card has reached its maximum allowed spending limit), will cause the transaction to be declined. This can lead to involuntary churn.

- Reported Cards (Stolen or Fraud): Reported cards involve credit cards that have been flagged for suspicious activity, such as being reported as stolen or fraudulent. Once deactivated, any new transactions, including subscription renewals or online purchases, will be declined.

- Wrong Billing Information: Incorrect billing information can disrupt payment processes. If the name or address provided does not match the records held by the bank, the payment may be declined. Inaccuracies in the card number or security code will also result in failed transactions.

How to Calculate Involuntary Churn?

Calculating the involuntary churn rate is a crucial step to understand payment-related issues, improve customer satisfaction, and optimize financial performance. Here’s the formula:

Involuntary Churn Rate = (Customers Lost to Failed Payments / Total Churn) * 100

To calculate the Involuntary Churn Rate, we need two pieces of information: the number of customers lost due to failed payments and the total number of customers lost (both voluntary and involuntary churn).

For example,

Let's say we have the following data for a given period:

- Customers Lost to Failed Payments: 50

- Total Churn: 200

Identify the number of customers lost to failed payments: In this example, it's 50.

Identify the total number of customers lost (total churn): In this example, it's 200.

Divide the number of customers lost to failed payments by the total churn: 50\200 = 0.25

Multiply by 100 to get the percentage: 0.25*100 = 25%

This means that 25% of the customers lost (churned) during the specified period were due to failed payments.

How Involuntary Churn Can Break a Business?

Involuntary churn is detrimental to online businesses, especially subscription-based ones. Most notable impacts can be seen in:

1. Lost Revenue

When customers churn involuntarily, businesses lose out on the revenue that these customers would have generated. This loss can be substantial, particularly for subscription-based models where recurring revenue depends on long-term customer retention. Each lost customer represents a loss in predictable, ongoing income, and for high-ticket products or services, the impact can be even more severe.

Involuntary churn can cause businesses to bleed out steady incomes!

2. Damage to Reputation

Involuntary churn can damage a business's reputation. When customers experience negative events like failed payments or difficulties accessing services, they are more likely to share their negative experiences with others.

In the age of social media and online reviews, this word-of-mouth can spread quickly, deterring potential new customers and tarnishing the brand's image. Poor handling of such issues can lead to a perception of incompetence or unreliability, which can be hard to recover from.

3. Increased Customer Acquisition Costs

Acquiring new customers is significantly more expensive than retaining existing ones. With each involuntary churn, not only does the business lose a revenue stream, but it also incurs additional costs to acquire new customers to replace those lost.

These costs include marketing expenses, promotional offers, and sales efforts. Over time, if involuntary churn is not addressed, the higher acquisition costs can eat into profits, making the business less sustainable.

Learn more: Unlocking the Potential: Boosting eCommerce Average Order Value

5 Tips to Effectively Prevent Involuntary Churn on Shopify

By far, we’ve all agreed that involuntary churn is bad and every Shopify store should try their best to avoid it. However, there’s no one-size-fits-all solution. Each business has unique customer demographics, product offerings, and operational nuances that require tailored strategies.

We design the following tips as a framework for Shopify merchants. From there, you can devise your own plans to reduce involuntary churn:

#1 Keep the Store Optimized And Always Running

There’s no use in designing a beautiful store if it isn’t online long enough to generate revenue. Ensuring your Shopify store is consistently running and well-optimized is crucial for reducing involuntary churn. Make sure that customers can access your website fast and securely.

Build an optimized, lightning fast Shopify store with GemPages.

Utilize GemPages, a powerful store builder, to significantly enhance your site's performance and user experience. Create high-converting, mobile-responsive pages without any coding knowledge with our robust drag-and-drop design. We enable complete customizability, expressing your brand identity while keeping it professional.

Explore hundreds of our ready-to-use themes for Shopify stores.

There are also GemPages' built-in optimization tools to guarantee that your site loads quickly, improving performance and reducing the risk of technical issues that could lead to involuntary churn.

#2 Implement a Grace Period for Transactions

A grace period is a set duration of extra time provided to customers after a payment due date, allowing them to make their payment without facing penalties or losing service. Implementing a grace period for failed transactions gives customers a chance to resolve payment issues without immediately losing their subscription or purchase.

Sending timely notifications to inform customers that their payment has failed is recommended. This proactive approach reduces involuntary churn by preventing immediate cancellations. It also enhances the customer experience by showing flexibility and understanding.

#3 Devise Recovery Strategies for Failed Payments

Always have a plan to efficiently recover failed payments. You can configure your payment system to automatically retry failed transactions after a certain period, such as 24 hours, to reduce churns. Smart dunning management tools that send progressively stronger reminders, starting with gentle prompts and escalating to more urgent notifications are also great options.

For high-value customers, personalized follow-ups from customer service representatives to assist with payment issues are the best. This approach combines automation and personalization to effectively resolve payment problems.

Learn more: Shopify Payments vs. Paypal: What's Best for You in 2024?

#4 Send In-App or Email Reminders for Unpaid Orders

Customers sometimes don’t pick up the items in the basket after failed transactions, even if the situation is resolved. Here, sending timely in-app or email reminders for unpaid orders is essential to reduce involuntary churn.

Notify customers of upcoming payments to prompt them to update their payment details. For previously failed payments, immediately inform customers via collection letters and provide clear steps to resolve the issue. Use straightforward instructions on how to update payment information or contact customer support.

Start zooming on the eCommerce lane by preventing involuntary churn.

#5 Offer Multiple Payment Methods

Having a variety of payment options can significantly reduce payment failures and involuntary churn. Besides credit/debit cards, enable payments through digital wallets like PayPal, Apple Pay, and Google Wallet. Bank Transfers or ACH payments and local payment methods are wonderful additions.

It’s a Wrap!

Involuntary churn is a nightmare for many eCommerce merchants, but it doesn’t have to be yours. By understanding the root causes of involuntary churn, such as payment failures, website downtime, and wrong billing information, you can implement tailored strategies to reduce it.

Try optimizing your store for performance and uptime, offering a grace period for transactions, devising robust recovery strategies, sending timely reminders, and providing multiple payment methods.

For even more robust functionality, use GemPages! Witness an uplift in site performance and user experience, further minimizing the risk of involuntary churn and lost revenue. Remember, sustained growth for your Shopify store can only come from a seamless shopping experience that keeps customers coming back for more!

Facebook Community

Facebook Community Change Log

Change Log Help Center

Help Center