- What is eCommerce Fraud?

- Types of eCommerce Fraud

- Signs that Your Shopify Store is Having eCommerce Fraud

- Best Practices to Prevent Fraud on Your Shopify Store

- 3 Brilliant Shopify Fraud Prevention Tools to Keep Your Store in Check

- Give Your Store the Protection It Deserves

- FAQ about Shopify Fraud Prevention

Shopify Fraud Prevention: Guide for Your eCommerce Store

this problem from your digital storefront, but solutions to keep it at bay are available.

In this blog post, get ready to learn the ins and outs of eCommerce fraud, alongside a practical list of Shopify fraud prevention methods to keep your store in check.

What is eCommerce Fraud?

Knowing what to expect when it comes to eCommerce fraud prepares sellers for abrupt cyber threats.

In a nutshell, eCommerce fraud refers to illegal activities that are performed by cybercriminals and scammers to obtain financial gains. Fraudulent payments, phishing scams, chargeback fraud, and the like are all classified as eCommerce fraud. If handled momentarily, online merchants could avoid serious financial losses and prolonged internal troubles.

With that being said, is eCommerce fraud a common occurrence? As 85% of global consumers being virtual shoppers, the eCommerce world is nothing short of roaring. This impressive data points to an undeniable outcome: the risk of fraudulent behavior is as high as ever.

Here are some notable statistics regarding eCommerce fraud activities, as compiled by Exploding Topics and Statista:

- eCommerce companies are estimated to lose $48 billion to fraud yearly

- 43% of consumers have fallen victim to payment fraud

- The eCommerce fraud detection and prevention market is forecast to grow over two-fold between the years 2023 and 2027

Learn more: Shopify Tutorial: Everything For Success [2024]

With many more digital scams on the rise, it is crucial for sellers to learn how to protect your business from detrimental mishaps caused by fraudulent activities. The list of fraud examples below will help you identify these unusual actions more effectively.

Types of eCommerce Fraud

eCommerce fraud is not a monolith. From subtle transaction irregularity to identity theft, your digital storefront runs into the risks of encountering cyber threats every step of the way as your business expands. Let’s walk through the most common types of eCommerce fraud that every merchant should make themselves familiar with.

Payment Fraud

Be aware of payment fraud as it has a direct impact on your store’s finances and reputation.

Payment fraud is a hard-hitting cyber threat since it could result in direct financial losses to your business. To perform this type of fraud, criminals use stolen card information to make a purchase from your store. Authentic card holders are often alerted of this unauthorized transaction, thus, could open a dispute where your business would have to shoulder the losses.

To stay away from this type of fraud from the get-go, sellers can implement simple strategies like fraud detection tools, monitor suspicious transactions, and the like.

Learn more: What is Shop pay and is it safe?

Phishing Scams

Your and your customer’s personal data could be at risk if phishing scams are at play.

Known under other names like pharming and whaling, this type of fraud has proven to be more prevalent in the eCommerce world than ever. The objective of a phishing scam is straightforward: to obtain sensitive information from your business or customers. By deceiving people with an impersonation, these scammers can get a hold of one’s login credentials, payment details, or unauthorized access to your bank account.

With the advanced tricks that fraudsters use, from fake emails or direct phone calls that put an everyday person on the spot, phishing scams were reported to amass a staggering 43% of merchants who have been impacted by this type of fraud in 2023.

While phishing scams might be rampant, the most efficient method to avoid falling for this cheeky fraud is by double-checking email addresses and dodging suspicious links. If you are a Shopify user, opting for a Shopify fraud prevention app will give you further assistance in minimizing phishing risks as well.

Pro tip: Use tools like GemPages to customize the checkout process, which can help lower the chances of fraudulent transactions.

Refund Fraud

The term ‘refund fraud’ is self-explanatory. This scam occurs when a customer deliberately tries to claim a refund based on wildly inaccurate reasons or submits multiple refund requests in a short period of time. On a more serious note, they might make an attempt to return counterfeit merchandise to your business.

This fraud concept exists across different niches but is more widespread in the fashion and electronics industries than most. The wardrobing phenomenon has singlehanded accounted for 49% of return fraud, as reported by fashion retailers in the past year. Meanwhile, electronic products are prone to have counterfeit versions, making them an ideal target for fraudsters. If your store does not possess a solid inspection policy, you might have to forfeit a refund or a replacement.

Identity Theft

Identity theft is a tricky issue in many departments of our daily lives, and online shopping is a hotbed for scammers to thrive in regard to stealing your information.

When a cybercriminal gets a hold of one’s full name, social security number, email address, phone number, login credentials, etc., it is more than enough to steal their identities for malicious intents. In the eCommerce world, this important data can be used to make fraudulent transactions and take over one’s account. While shoppers are the most affected individuals, online merchants are not exempt from this fishy scam. Business owners might assume that the scammers are genuine clients and process consequential actions like refunding or closing accounts, highlighting the importance of identity theft insurance as a protective measure against such losses.

Chargeback Fraud

Chargeback fraud is an easily preventable threat due to its friendly and elementary nature

Also known as ‘friendly fraud’, chargeback fraud is another type of cyber risk that sellers have to be mindful of. Similar to refund abuse, this type of eCommerce fraud stems from your own customers. When a legitimate purchase is finished, some buyers might attempt to dispute the charge with their banks based on various claims. Whether the product never arrived or they were charged twice, this type of fraud is milder than other external cyber threats. However, merchants still run the risk of losing revenue, chargeback fees, as well as the brand’s reputation and trust.

Triangulation Fraud

This type of eCommerce scam stands out from this list, due to its complex concept and unexpected consequences. Instead of stealing customer’s identity, criminals aim at digital stores. The process is as follows: scammers set up a store to imitate your website, visitors proceed to purchase from said store and simultaneously hand out their card information, and scammers then use these payment details to buy products from your actual store.

Once they have got their hands on this payment information, it does not stop at one singular purchase. This valuable information will be taken advantage of to make more purchases on other websites, or sold on the dark web for other malicious purposes.

The ultimate goals of triangulation fraud are first, to scout and steal customer’s payment details, and second, to swing at genuine online stores by making them suffer a loss should a fraudulent charge be processed.

Loyalty Abuse

Online merchants ought to be careful with their reward programs to eliminate loyalty abuse - an exploitation tactic that poses serious risks to the business.

A loyalty program is a solid marketing strategy that businesses of all shapes and sizes have favored. If you are based on Shopify, it is not difficult to come across a wide array of apps to help you ace this rewarding tactic.

That said, scammers will find a loophole to cheat by any means, especially when everything can be searched up and manipulated through a computer screen. Loyalty abuse is one of the eCommerce frauds that merchants have grown wary of. Whether it is an affiliate, promotion, or loyalty program, cybercriminals can spam site traffic, steal credit card information, or hack into active customer accounts and redeem points in exchange for incentives. With this type of fraud, no amount of caution is enough. Since one store can have an extensive account database, it is recommended to opt for a third-party app that tracks client activities, such as a Shopify fraud detection app. The earlier you are aware of these unusual actions in regard to your loyalty programs, the less risk there will be for you to contend.

Signs that Your Shopify Store is Having eCommerce Fraud

We have gone over the most common eCommerce fraud, but when they are actually affecting your store, it is not always on the nose. To level up your inspection skill, take a peep at the signs that your Shopify store is being compromised by cyber attacks below:

- Suspicious Orders: if fraudsters have customer’s payment information in their possession, they have the tendency to get the most out of the card/virtual wallet by placing a high-value order or multiple orders rapidly. Spotting this unusual activity is the most crucial step in putting a stop to this common fraud.

- Unusual Credit Card Use: genuine customers often have a pretty straightforward checkout process, especially in the payment step. On the other hand, scammers might leave a trail of failed payment attempts, use of declined cards, and other abnormal payment issues.

- Odd Purchasing Behavior: issues around purchases not only about the order value or frequency. Activities like inconsistent contact info, unusual products, or suspicious IP locations are all signs that should not be overlooked.

Best Practices to Prevent Fraud on Your Shopify Store

With the surge of online shopping, fraudsters are always on the hunt for slier scams that have a major impact on both the customers and yourself. At the moment, it is a good call to make yourself familiar with the tried-and-true methods of the predecessors to protect your digital storefront from cyber threats.

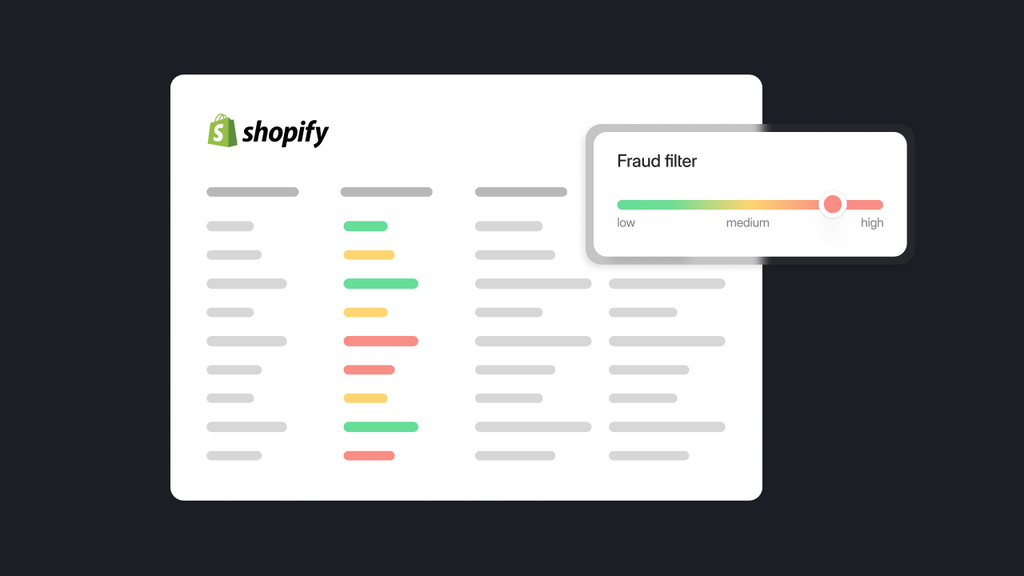

Make Use of Shopify Fraud Prevention Tools

When you are a part of the Shopify ecosystem, the possibilities are endless when it comes to built-in tools that bring out your store’s best potential. In the subject of fraud prevention, options like fraud analysis or Shopify Protect are the MVPs in keeping the threats to a minimum. Before seeking external assistance, make sure to try your hands on these tools and watch how your store performs.

Pro tip: To truly elevate your online store's capabilities, consider integrating GemPages. This powerful page builder allows you to easily create stunning, high-converting landing pages, providing additional customization options that can help facilitate better user experiences and ultimately reduce the risk of fraud.

Manually Review Risky Orders and Transactions

This era of automated tools and AI services might make us feel like manual efforts are only secondary. That said, manually reviewing unusual site activities is the key to keeping your store’s performance. This process enables merchants to contact customers directly and offer timely support instead of relying on machines.

Utilized Trustworthy Payment Gateways

A reliable payment gateway system brings more benefits to your website than you thought. Apart from giving you an edge over the competitors, attracting a diverse customer portfolio, boosting brand image, etc., fraudulent transactions are also minimized. A highlight of fraud prevention for Shopify is Shopify Payments - the platform’s official payment method that protects you and your customers for an enjoyable shopping experience every time.

Use Detail Verification Software

A solid verification software covers identity, card information, address, phone number, etc. While not always visible to shoppers, most Shopify-powered stores are equipped with these multi-step verification tools to ensure a smooth-sailing shopping journey. In the long haul, they also shield the businesses from fraudulent activities and protect all parties.

Develop a Blocklist

Getting scammed once is bad, but falling for fraudsters for the second time poses serious risks to your business. That’s why a blocklist of banned IP addresses, credit card numbers, emails, shipping addresses, and the like is vital. Once it is included in this list, any attempt at invading your website will be instantly blocked, keeping fraud from happening again.

Conduct Fraud Awareness Training

Focusing on the problems at their roots is one of the best methods for maintaining a reputable store. A rule of thumb is to conduct regular employee training on fraud awareness and develop a thorough fraud detection guidebook for future use. Including industry-recognized training, such as Cisco Certifications, can help equip your team with the necessary skills to detect and prevent fraud. The more knowledgeable your team is, the better your brand will perform.

Keep Evidence of Fraud

Should it ever come a time for chargebacks and disputes, you’d be glad that the evidence of fraud is at your disposal. Details like messages, email exchanges, invoices, order details, and so on are all worth documenting to prevent scams and redundant back and forth.

3 Brilliant Shopify Fraud Prevention Tools to Keep Your Store in Check

Shopify Protect

Protect your store from malicious scams with Shopify’s built-in fraud prevention tool.

Shopify Protect is Shopify’s very own fraud prevention tool, which is available for all stores with Shopify Payments integrated. Its automatic features protect your store from chargeback frauds by reviewing transactions based on its analysis benchmark. The premise is clear, simple, and frictionless. Businesses of all stages are welcome to utilize this versatile tool without additional costs.

Signifyd

Let Signifyd give you a helping hand in preventing fraud with both your business and customers in mind.

If you want to try out a third-party tool, Signifyd is where to start. Its advanced features make it stand out among other tools with the same objective, namely real-time fraud detection, chargeback reimbursement, high-volume transaction processor, etc. Designed for large-scale businesses, Signifyd could be your next match to get rid of the dreaded cyber attacks.

Kount

Kount is the ultimate solution to protect your business from cyber threats and ensure steady growth.

AI in eCommerce has seen an impressive spike in recent years, thus, it is not surprising to see tools like Kount start to implement the undeniable convenience of AI to assist online merchants. This fully Shopify-integrated solution offers AI-powered fraud detection features, digital identification, custom fraud protection rules, and so on. If you are searching for something avant-garde, Kount will get you covered.

Give Your Store the Protection It Deserves

Every business owner knows a slight mishap can have an adverse impact on one’s brand, especially when financial losses are imminent. Thus, it is time for you to grant your store the protection it deserves from cyber threats and tricky scams, whether from an all-in-one app or through preventative measures.

Facebook Community

Facebook Community Change Log

Change Log Help Center

Help Center