- What is Shop Pay?

- How Does Shop Pay Work?

- Is Shop Pay Safe?

- Shop Pay Reviews & Benefits of Shop Pay

- How to Set Up Shop Pay on Your Shopify Store

- Who accepts Shop Pay?

- What is Shop Pay Installments and How Does it Work?

- Top Stores that Accept Shop Pay Installments

- Shop Pay vs Afterpay vs PayPal - What’s the difference?

- What are the alternatives to Shop Pay?

- Final Thoughts on Shop Pay

- FAQs about Shop Pay

What is Shop Pay and Is It Safe?

Everything’s getting faster in eCommerce, and “checkout” is no exception!

When a customer is on the checkout page, all you want them to do is hit that Pay now button and complete their purchase.

If they exit the checkout page, most likely, you may lose the sale.

So, it’s crucial to have a seamless checkout experience for your store’s sales and conversions. And that’s where Shop Pay can be your solution.

In this blog post, we’ll be covering important questions like what is Shop Pay and is it safe, what are the benefits of using Shop Pay, and one of its crucial features, Shop Pay Installments.

For further information, visit our blog for more in-depth knowledge about eCommerce

What is Shop Pay?

Shop Pay is a payment method that helps customers with a faster checkout experience on Shopify stores by allowing them to securely save their email address, payment and billing details for future purchases.

This can enhance the customer experience by saving their time, especially for the customers who've already opted in to Shop Pay through any Shopify store.

Upon opting-in by a customer, Shop Pay securely encrypts and stores the following details so that the customer won’t have to fill it again during future checkouts:

- Email address

- Shipping Address

- Billing Address

- Credit Card Information

- Phone Number

During checkout, customers have the option to either complete the payment through Express checkout or manually fill in all the required fields and then complete the payment.

How Does Shop Pay Work?

When filling in the payment and shipping details during checkout, customers can opt-in to save their information with Shop Pay. So, whenever they check out at any Shopify store in the future, they can auto-fill the necessary information by simply providing their email address and the SMS verification code.

During checkout, customers are offered the Remember me option to save their information for future checkouts. However, a customer must insert an email address in the given field at checkout.

Customers who insert only the phone number and not the email address won’t be offered the Remember me option, meaning they won’t be able to save their information.

Shop Pay allows your customers to save up to 10 credit cards and a maximum of 20 shipping addresses.

Cards Accepted by Shop Pay:

- Visa/Visa Debit

- Mastercard

- American Express

- Other cards supported by you as an online store owner

To use the supported cards on Shop Pay, customers need to ensure the following aspects:

- Customers must activate their cards before using them with Shop Pay.

- Customers must have the billing information matching the bank account on file.

Example: The zip code in the billing address must match the one that is on the bank account. - Some prepaid cards may not be supported by Shop Pay. Thus, customers need to ensure that they are using a supported debit or credit card.

Does Shop Pay check the credit score or impact the credit score?

When a customer selects the option to pay for the order with four biweekly payment installments, the customer’s credit score won’t be impacted.

However, if a customer selects the option to pay for the order with monthly payments, and fails to make those payments on time, the customer’s credit score might get impacted. In other words, the monthly payment option does have the possibility of impacting the customer’s credit score.

Learn more: Shop Pay vs. PayPal: Which One is Better for Your Business?

Is Shop Pay Safe?

Yes, Shop Pay is completely safe and secure for your customers.

Since Shop Pay deals with the sensitive information of your customers, it’s quite understandable to have such question about security. However, Shopify is known to be one of the best eCommerce platforms because of its high safety and security standards.

Shopify is a Payment Card Industry Data Security Standards (PCI DSS/PCI-Compliant) Company

Shopify is certified to be Level 1 PCI DSS compliant, which is a security standard for companies that deal with credit and debit card details.

By default, all Shopify stores are automatically PCI compliant. When customers opt-in to save their information for future checkouts, it is encrypted and stored securely on Shopify’s PCI-compliant servers.

Added Security with Shop Pay Verification Code

On top of the above security measures, the SMS verification codes also add a layer to security by ensuring that Shop Pay is used by the account holder only.

Pro tip: After checkout, these customers are still potential buyers for your Shopify stores, which is when post-purchase pages appear and show the potential to convert customers.

Shop Pay Reviews & Benefits of Shop Pay

Overall, if you look at Shop Pay holistically, it has a mix of positive and negative reviews from different merchants. That said, many Shopify merchants have leveraged this tool and have talked about how their business has benefited from it.

Shop Pay is not a mandatory payment method but an optional one. So, you have the flexibility to keep it or remove it. However, you should definitely consider all the benefits that come with Shop Pay before making the final decision.

Here’s one of the tweets about Shop Pay from Harley Finkelstein - President of Shopify:

Shopify in 2022 vs 2019:

— Harley Finkelstein (@harleyf) February 15, 2023

- Grew GMV 3x to nearly $200B

- Added $4B in Revenue, reaching $5.6B

- More merchants are adopting more of our solutions (POS, Capital, Shop Pay etc.)

Commerce moves fast, but @Shopify moves faster.

So, let’s take a look a look at the benefits of Shop Pay to see how it can help your business:

Enhance Customer Experience

With Shop Pay, customers won’t have to insert all their details every time they want to buy something from your store. Shop Pay makes the checkout process 4 times faster than regular checkouts.

Thus, Shop Pay helps customers save valuable time and it can enhance their shopping experience.

Increase your Average Order Value

Since Shop Pay makes it easier for customers to purchase expensive products with installments, it also increases your average order value (AOV).

During the early access of Shop Pay Installments, it was found that 25% of merchants had a 50% higher average order value compared to other payment options.

Boost Your Conversion Rate

Shop Pay Installments can help boost your store’s conversion rates. Shopify store owners who switched from a third-party solution to Shop Pay Installments for the ‘buy now, pay later’ offer, noticed 28% fewer cart abandonments.

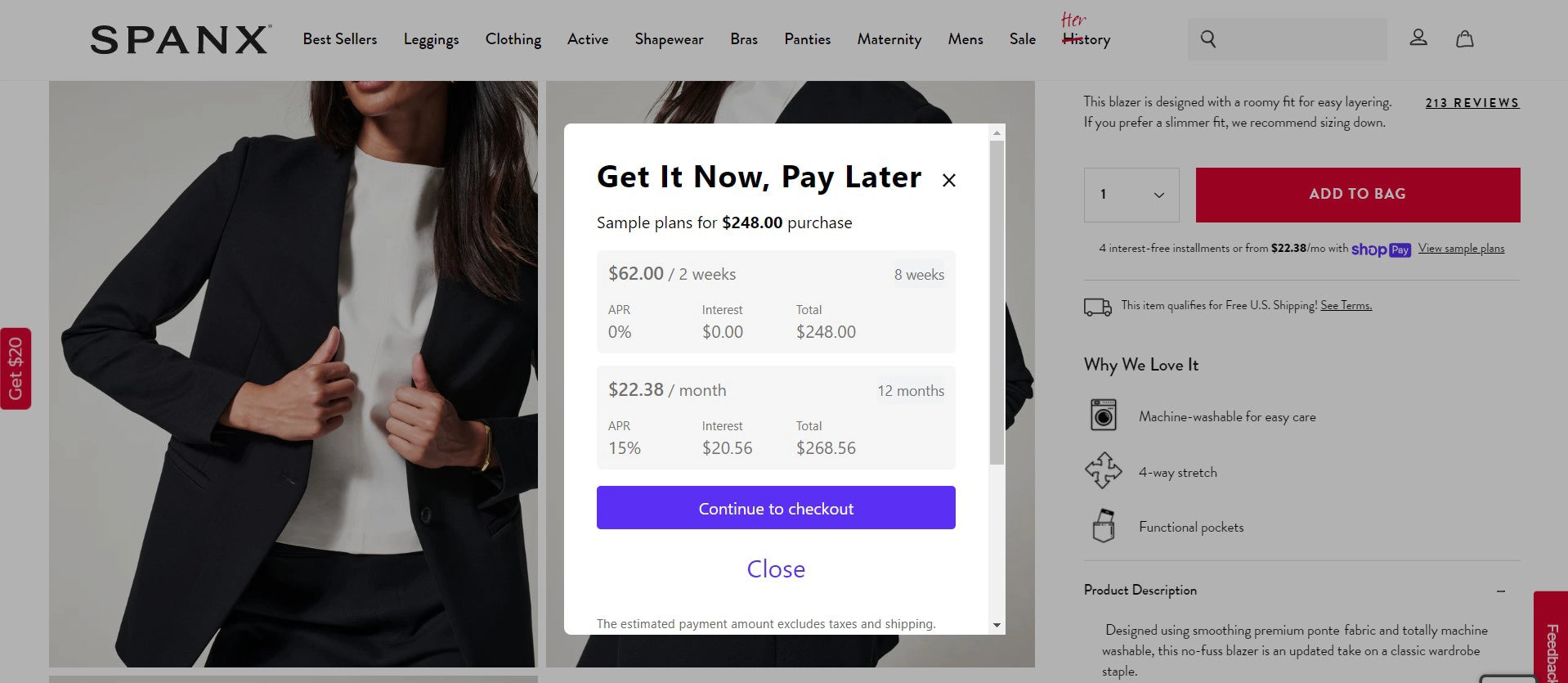

On Spanx’s product page, the Shop Pay Installments offer is mentioned right below the CTA (Call to Action) button. Informing your customers about this convenient payment option can increase your conversion rate.

If you are selling expensive products (or a high-ticket niche) on your store, you can also promote Shop Pay Installments by adding a great copy inside a banner. This will help you highlight the Shop Pay Installments on top of the homepage as well as other store pages.

Leverage a Vast Consumer Network in the US

With a combination of Shop Pay and Shop (Shopify’s shopping assistant app), you can access a huge customer base. In fact, millions of US customers are already making purchases through Shop Pay and using the Shop app to track their shipments on a real-time basis.

On average, 43% of customers already use Shop Pay as their preferred checkout method.

Learn more: How To See What Apps A Shopify Store Is Using: A Complete Guide

Gain the Trust of Your Customers

Customers can take advantage of interest-free installment payments without worrying about any additional hidden charges or late fees. By providing complete transparency through Affirm and enhanced security of Shopify, store owners can build trust with customers.

Help Protecting the Environment

By using Shop Pay at checkout, you can also contribute to the betterment of the environment. Yes, every time a customer completes a checkout with Shop Pay, it’s helping Shopify’s Sustainability Fund.

These funds help support companies working on reversing climate change with their carbon removal project. A couple of examples of such companies are Planetary and Remora.

In 2020-2021, Shop Pay helped to protect 123.6 million at-risk trees in the Peruvian rainforest. The project was done with help from Pachama.

Learn more: Eco-Friendly Products of 2025: The Best Sustainable Products to Sell

How to Set Up Shop Pay on Your Shopify Store

Activating Shop Pay on your Shopify store is quite easy!

You can enable Shop Pay on your store with Shopify Payments as well as third-party payment gateways.

Enable Shop Pay with Shopify Payments:

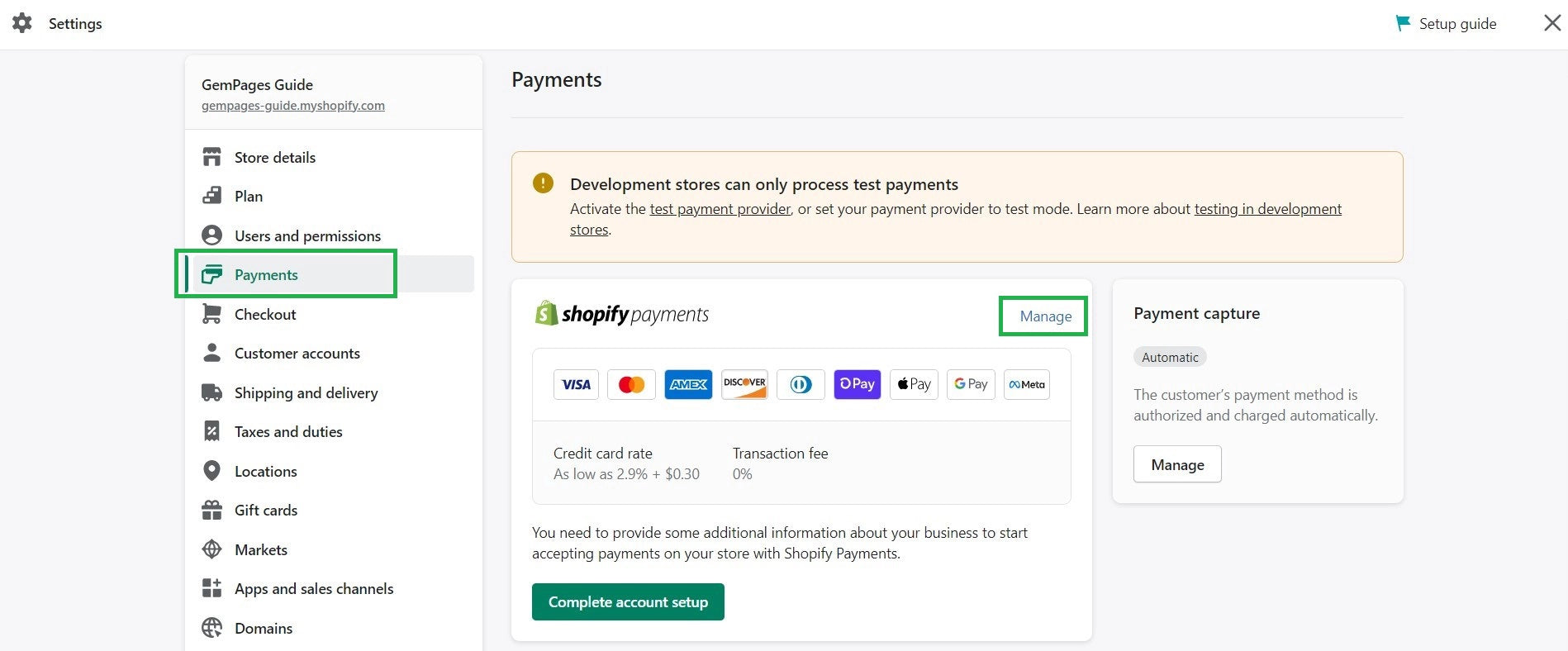

1. Go to Shopify admin and click on Settings > Payments.

2. Click on the Manage tab in the Shopify Payments section.

3. Scroll down to find the Shop Pay section under Payments and click on the checkbox.

4. Click the Save button to save your settings.

And that’s it! Your customer can start using the Shop Pay express checkout method.

Enable Shop Pay with Third-Party Payment Gateways:

By activating Shop Pay with third-party payment gateways, you can activate Shop Pay’s accelerated checkout on your online store, Facebook, and Instagram.

Important note: To activate Shop Pay with a third-party payment gateway, your online store should be in the United States and it must meet all the Shopify Payment requirements.

1. Go to your Shopify admin, and then click on Settings > Payments.

2. Then, click on the Manage tab in your third-party payment provider’s section.

3. Under the Shop Pay section, check the Enable Shop Pay checkbox and then click Save.

4. Click on Complete set up, and fill in all the necessary details about your store and banking details. Once done, click the Save button.

- It’s necessary for you to complete the Shop Pay setup with your business information and banking details so that you can receive your payouts.

- If you activate Shop Pay without completing the set-up, you must complete it within 21 days from the day you receive your first payment via Shop Pay.

- If you fail to complete the set-up within the given period of 21 days, all payments received through Shop Pay would be automatically refunded to the respective customers.

Who accepts Shop Pay?

There are many top brands that use or accept the Shop Pay payment method. Here are a few examples for your reference:

Olaplex - Hair Care Brand

Olaplex is one of the biggest independent hair care brands globally that has more than 100 worldwide patents for its products. Olaplex offers Shop Pay as one of the express checkout options along with Amazon Pay, PayPal, and G Pay.

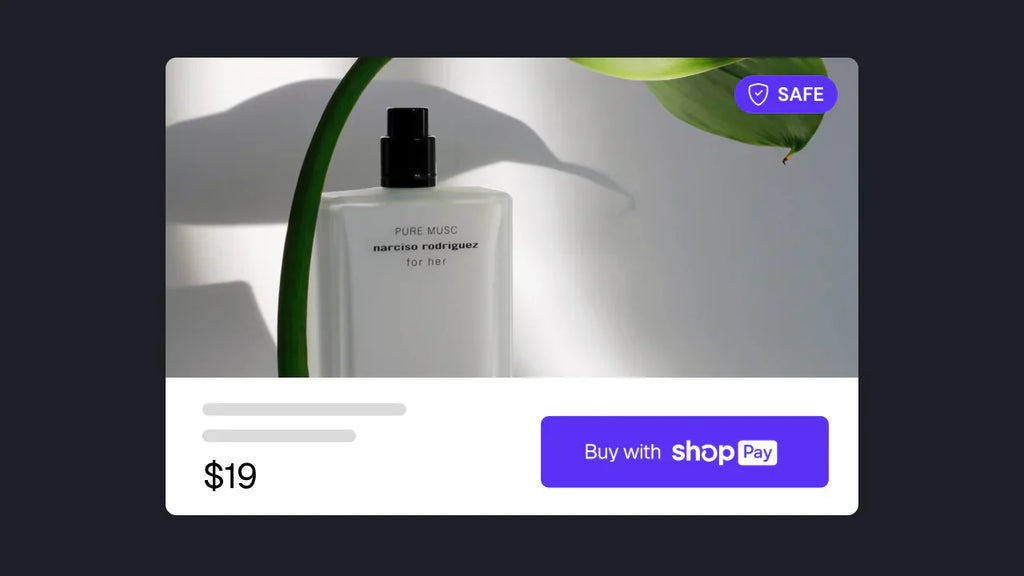

Dossier - Luxury Perfume Brand

Dossier is a brand with a mission to make premium fragrances available to all, and that's why this brand offers luxury perfumes for men and women at fair prices. Dossier uses Shop Pay.

Gymshark - Gym Clothing Brand

Gymshark is one of the most popular brands powered by Shopify. The brand offers gym clothing items, essentials, and accessories for men and women.

Important notes: While Gymshark does use Shop Pay as one of the accelerated payment methods, it is to be noted that the brand uses Klarna and Afterpay for installment payments instead of Shop Pay Installments.

What is Shop Pay Installments and How Does it Work?

Shop Pay Installments is a “Buy now, pay later” payment method available to Shopify merchants, powered by Affirm.

If you’re using Shop Pay on your store, your customers can make a full payment for the order or divide the full amount into installment payments. To be eligible for installment payments, the order value must be between USD $50 and $17,500.

Customers can select either of the following installment payment options:

- Four biweekly payments that are interest-free and applicable for orders starting from USD $50 to $999.99.

- Monthly installment payments are applicable for orders from USD $150 to $17,500. These are interest-bearing payments ranging from 10 to 36% APR (Annual Percentage Rate). It can be paid in a 3, 6, or 12 months period based on the order value.

Shop Pay Installments was launched in the US by Shopify in partnership with Affirm in June 2021.

Here are Shopify’s eligibility criteria for using Shop Pay Installments:

- You must be based in the United States.

- Your selling currency needs to be USD.

- Both Shopify Payments and Shop Pay must be activated.

Reasons for Shop Pay Installments account suspension:

If you're using Shop Pay Installments, keep in mind that your store may be periodically reviewed by Affirm to ensure it's in compliance with their policy for prohibited businesses.

If your store is found to be breaching its policy, Shop Pay Installments could be suspended for your store. Here are some of the examples that may lead to your Shop Pay Installment account suspension:

- Your online store is password-protected.

- Your store’s primary currency is not set as USD.

- Your store’s primary language is not English.

- There’s no active online website for your Shopify store.

- You’re primarily operating a Business-to-Business (B2B) service business.

- Your store is involved in any of the following: Gambling, financial services, or any other business category not supported by Affirm.

- Your store is selling regulated products such as tobacco, alcohol, or drug paraphernalia.

- Your store is selling restricted products such as weapons, currencies, or adult toys.

Learn more: Can You Sell CBD on Shopify? Yes! Here’s How

Top Stores that Accept Shop Pay Installments

Spanx - Clothing Brand

Pro tip: Create a special landing page for your flash sale promotion. You can use GemPages to create Conversion-Focused Page Builder using its AI-powered feature, templates, or drag-and-drop visual editor. Don't miss out on grabbing an exclusive 20% OFF this Black Friday with GemPages today!

Kelley Baker Brows - Brow Products & Training

Vici - Clothing & Accessories

Vici is a clothing brand with a mission to make on-trend styles instantly available and affordable for women. What’s interesting is that Vici offers its customers not just one but three different payment options for installments, i.e., Shop Pay, Klarna, and Afterpay.

Shop Pay vs Afterpay vs PayPal - What’s the difference?

Is Shop Pay and Afterpay the same? Well, not quite. Shop Pay and AfterPay may sound like similar payment methods but they aren’t exactly the same.

One of the popular Shopify stores, Kylie Cosmetics, uses Afterpay.

At Kylie Cosmetics, customers can use Afterpay for any orders between $1-$2000. Thus, customers can take advantage of interest-free payments even for small orders less than $50.

At Kylie Cosmetics, customers can use Afterpay for any orders between $1-$2000. Thus, customers can take advantage of interest-free payments even for small orders less than $50.

Some store owners may also be interested in knowing the comparison of Shop Pay vs PayPal. So, we decided to make your job much easier by comparing these 3 widely-used payment methods.

| Key Points | Shop Pay | Afterpay | PayPal |

| What is it? | Shop Pay is an accelerated checkout solution that allows Shopify stores’ customers to save their email, payment, and billing details for future purchases. | Afterpay is a “buy now, pay later” payment solution that is somewhat similar to Shop Pay Installments. It allows customers to make payments in installments with four equal and interest-free installments. | In the context of Shopify, PayPal is an additional payment method that lets customers make payments through their credit cards, buyer credits, bank accounts, and PayPal account balance. |

| Installment Payments | Yes - it can be added with Shop Pay Installments. | Yes - it’s the core feature. | Not available. |

| History | Shop Pay was launched by Shopify in 2017, in partnership with Affirm - which is a US-based company that was launched in 2012. | Afterpay is an Australia-based company that was founded in 2014, and thus, it's relatively new in the market. | Founded in 1998, PayPal is a US-based company that’s been in the market of digital payments for over two decades. |

| Fees for Store Owners | To enable Shop Pay, there's no fee. However, if you’re offering Shop Pay Installments, there's a 5-6% fee for each transaction. | Afterpay has commission fees of around 4-6% + $0.30 per transaction. On top of that, recently, Shopify has started charging a 2% commission on payments made through Afterpay. | Selling in the US: 2.9% of the transaction + a flat fee of $0.30 USD Outside of the US: 4.4% of the transaction + a fixed fee depending on the currency |

Learn more:

Shopify Payments vs. Paypal: What's Best for You in 2025?

Shop Pay vs Paypal: What is The Key Difference?

Shop Pay vs Afterpay: A Side-by-side Comparison of Features and Functionality

What are the alternatives to Shop Pay?

If you’re looking for other payment methods for express checkout, there are some alternatives to Shop Pay that you may consider.

Apple Pay

You can enable the Apple Pay payment option on your Shopify store. Apple Pay also offers an accelerated checkout experience to your customers.

When a customer makes the order payment through Apple Pay, they are not required to manually fill in their credit card info and shipping details.

Once the customer taps the Apple Pay button, they just need to scan their fingerprint and Apple Pay takes care of providing the necessary details to the payment provider.

To enable the Apple Pay payment method on your Shopify store, you must have one of the below-mentioned credit card payment providers:

- Shopify Payments

- Stripe

- First Data Payeezy

- Authorize.net

- CyberSource

- Braintree

Also, your domain’s SSL certification must be activated and you must follow Apple’s Acceptable of Use Guidelines.

Google Pay

Google Pay also allows your customers to securely process the payment through an accelerated checkout. Just like Shop Pay and Apple Pay, when your customers make payments through Google Pay, they won’t need to enter their credit card and shipping details.

In this case, the customer just needs to tap the Google Pay button, and the rest is taken care of by Google Pay. For enabling Google Pay on your Shopify store, you must be using Shopify Payments.

Final Thoughts on Shop Pay

Customers expect a seamless experience while shopping online. Whether it’s your website’s load speed or the checkout process, they don’t want to keep waiting.

Shop Pay is one of the great ways to make it easy and fast for your customers to complete the checkout process. Whether you’re looking to start a brand new Shopify store or want to enhance the customer experience on your existing Shopify store, you should definitely check out Shop Pay.

With all that said, keep in mind that Shop Pay is not the only option and there are alternatives as well. In the eCommerce industry, it’s common to test different options or run A/B testing to see which one works the best.

Important note: Please know the fees and some other requirements mentioned in this article are subject to change from time to time.

FAQs about Shop Pay

Facebook Community

Facebook Community Change Log

Change Log Help Center

Help Center